National Australia Bank

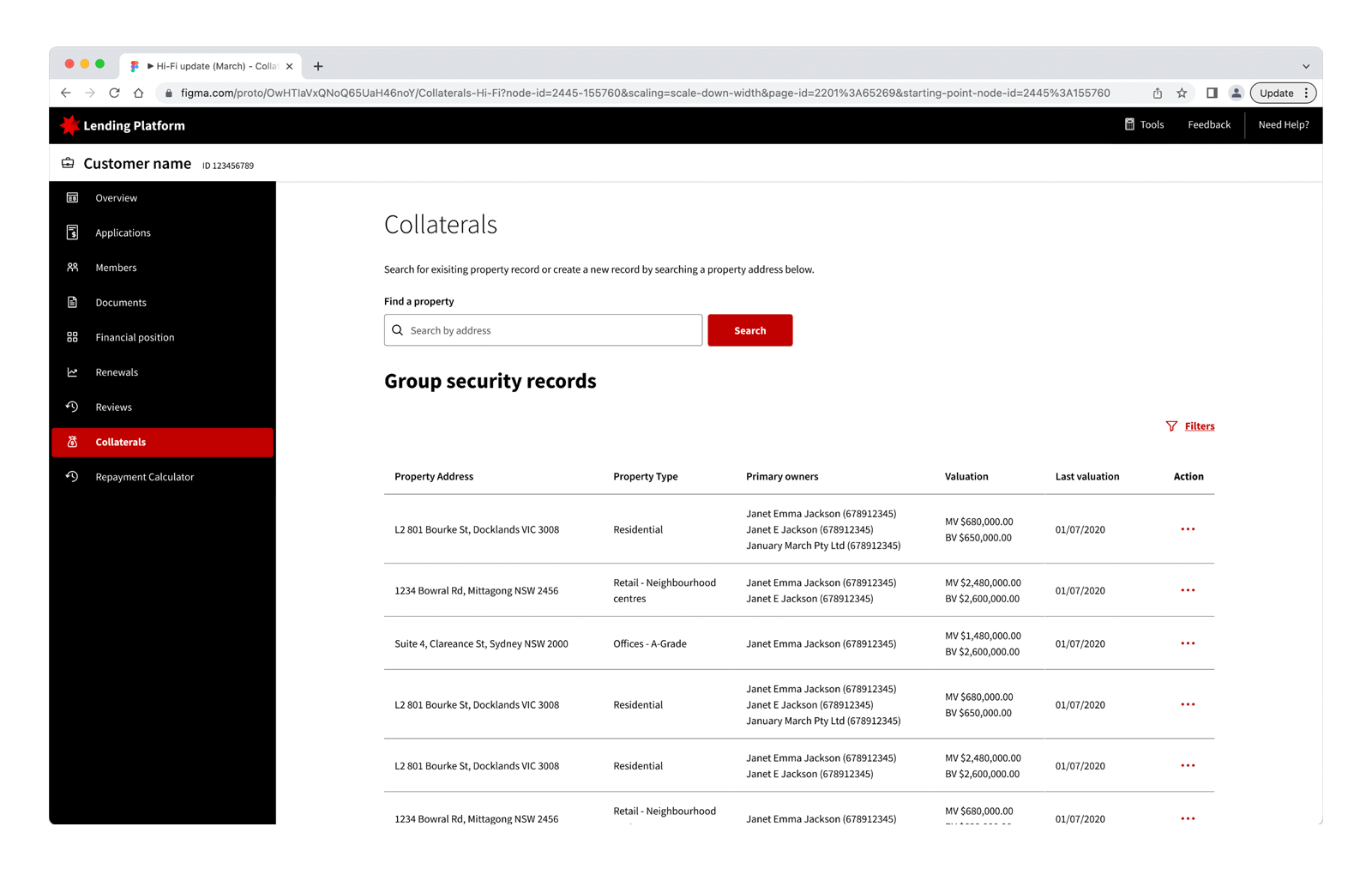

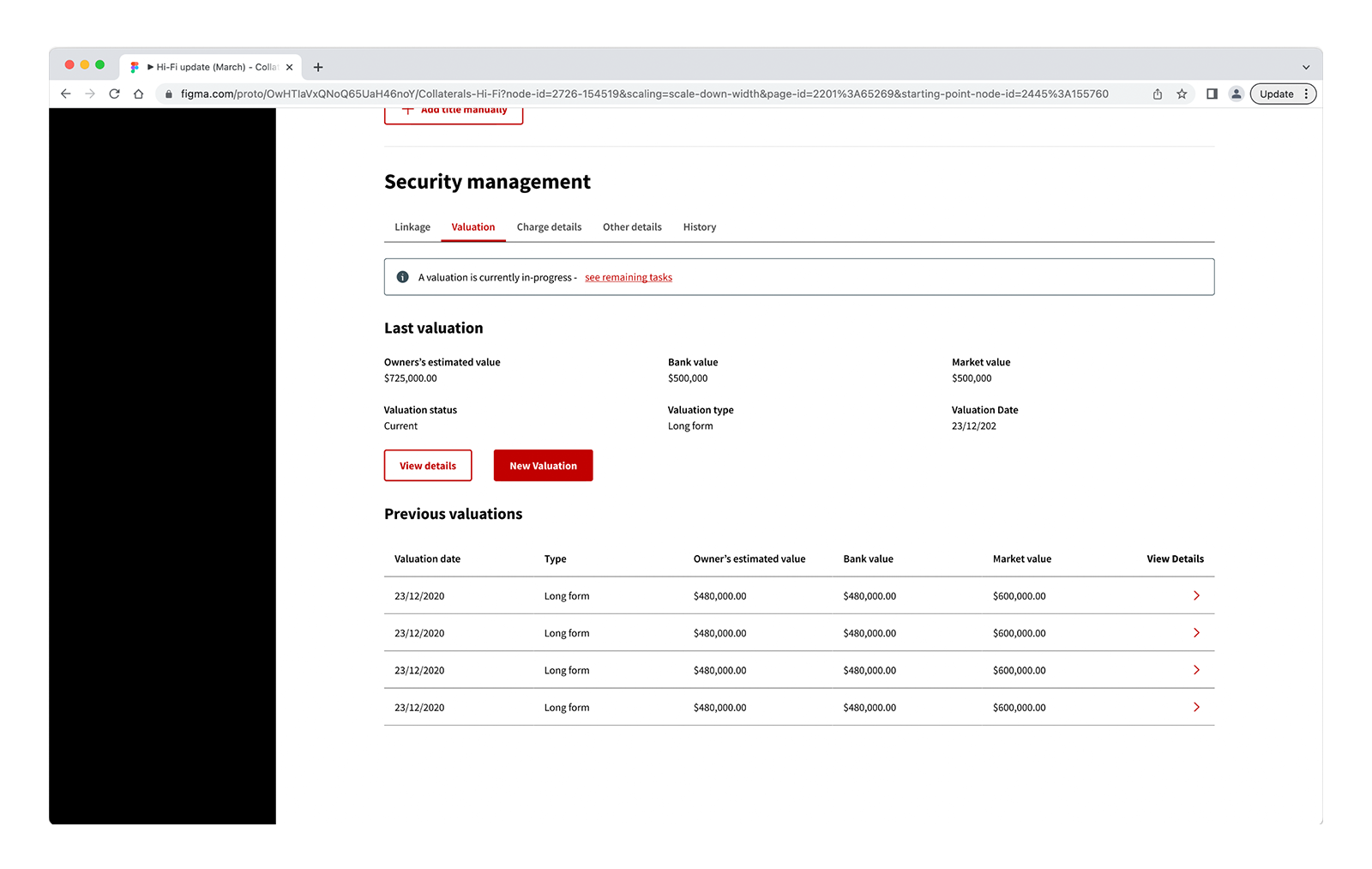

Security management

Replacing and enhancing the management of securities & collateral for business lending

CX research & design

CX research & design

Legacy solutions for security and collateral management are inaccessible, unscalable and lacking data integrity, causing inaccurate outcomes and re-work, particularly for our more inexperienced bankers.

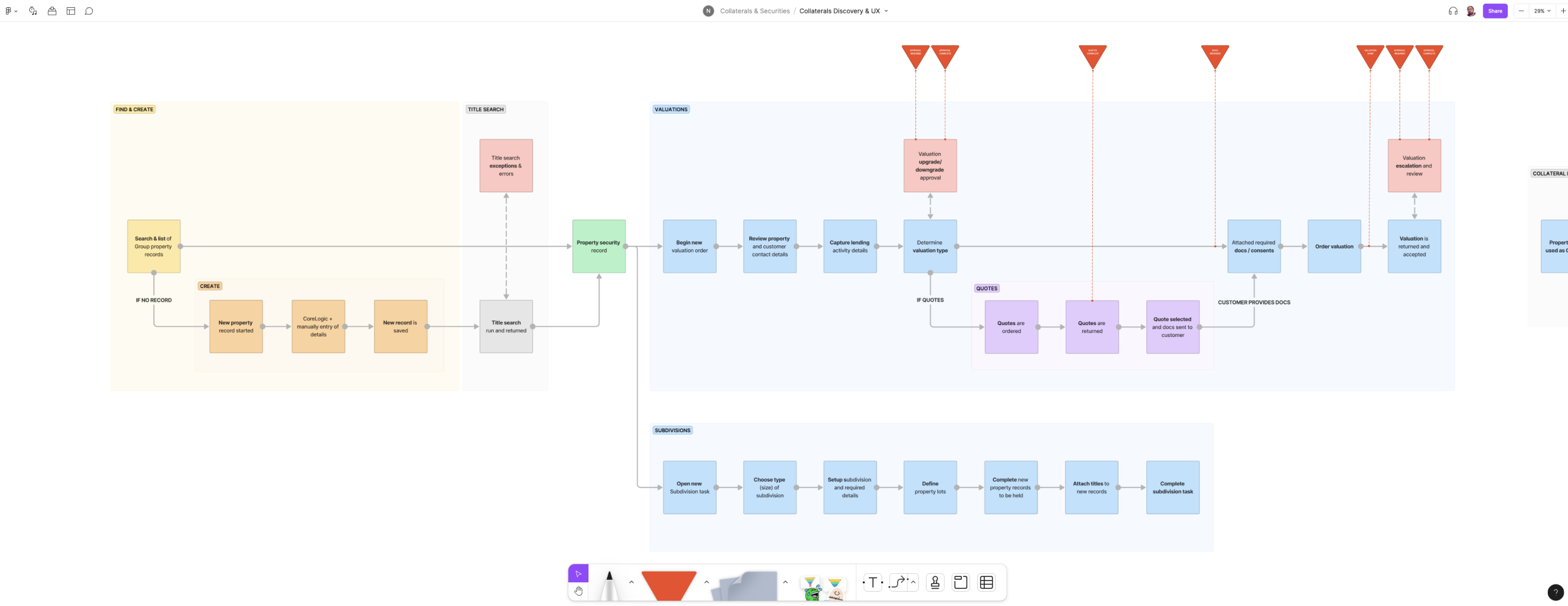

Service & system mapping

While the project was born out of strategic business needs for an enterprise-level securities database, the benefits for our bankers in their day-to-day roles were very strong. But we still needed to better undertand our bankers, their varied roles and the workflows they required to complete tasks related to security management.

We spoke with a number of bankers from each cohort and gained a great deal of knowledge and insight into their current workflows, existing problems, pain-points and opportunities, to help us identify and prioritise possible solutions.

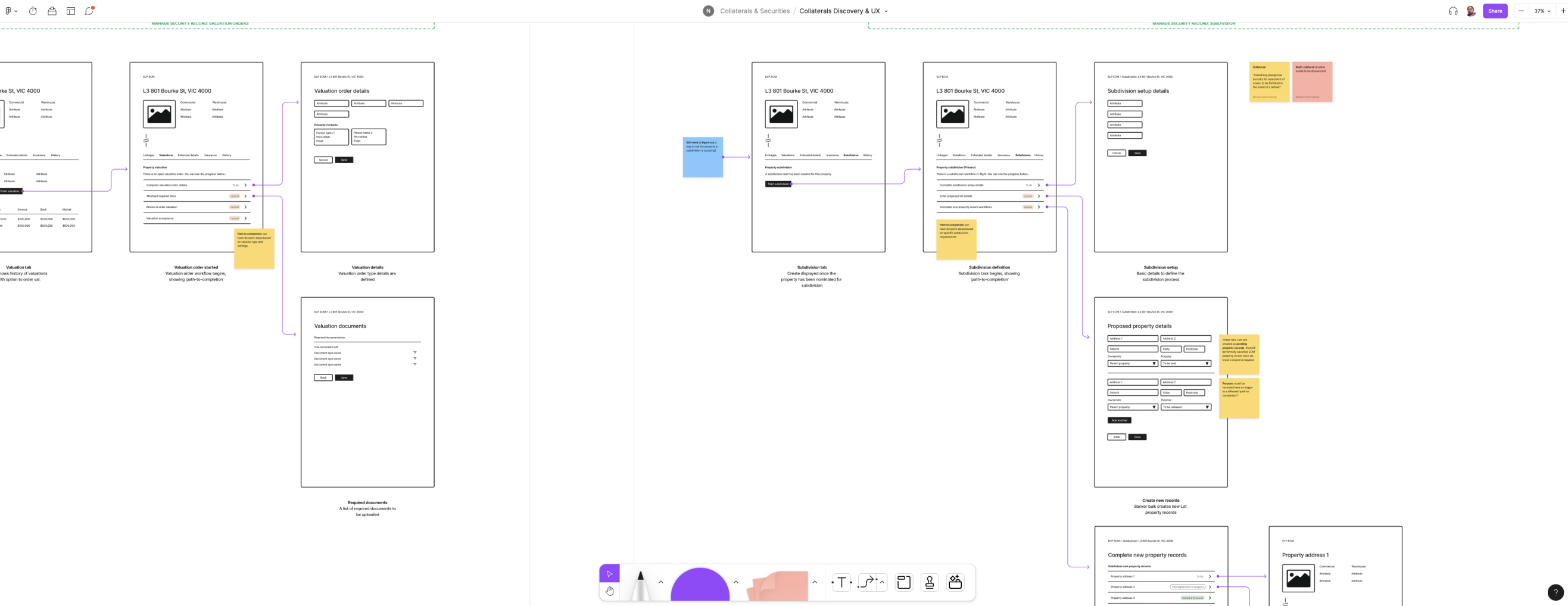

With time and budgets not on our side, it was important to hit the ground running. Having identified the main problem areas for our bankers, we moved quickly into low-fi prototyping, so we could begin getting ideas in front of our users and collect feedback and further insights.

Service & system mapping

Banker interviews

Prototype testing

Low-fi customer experience design

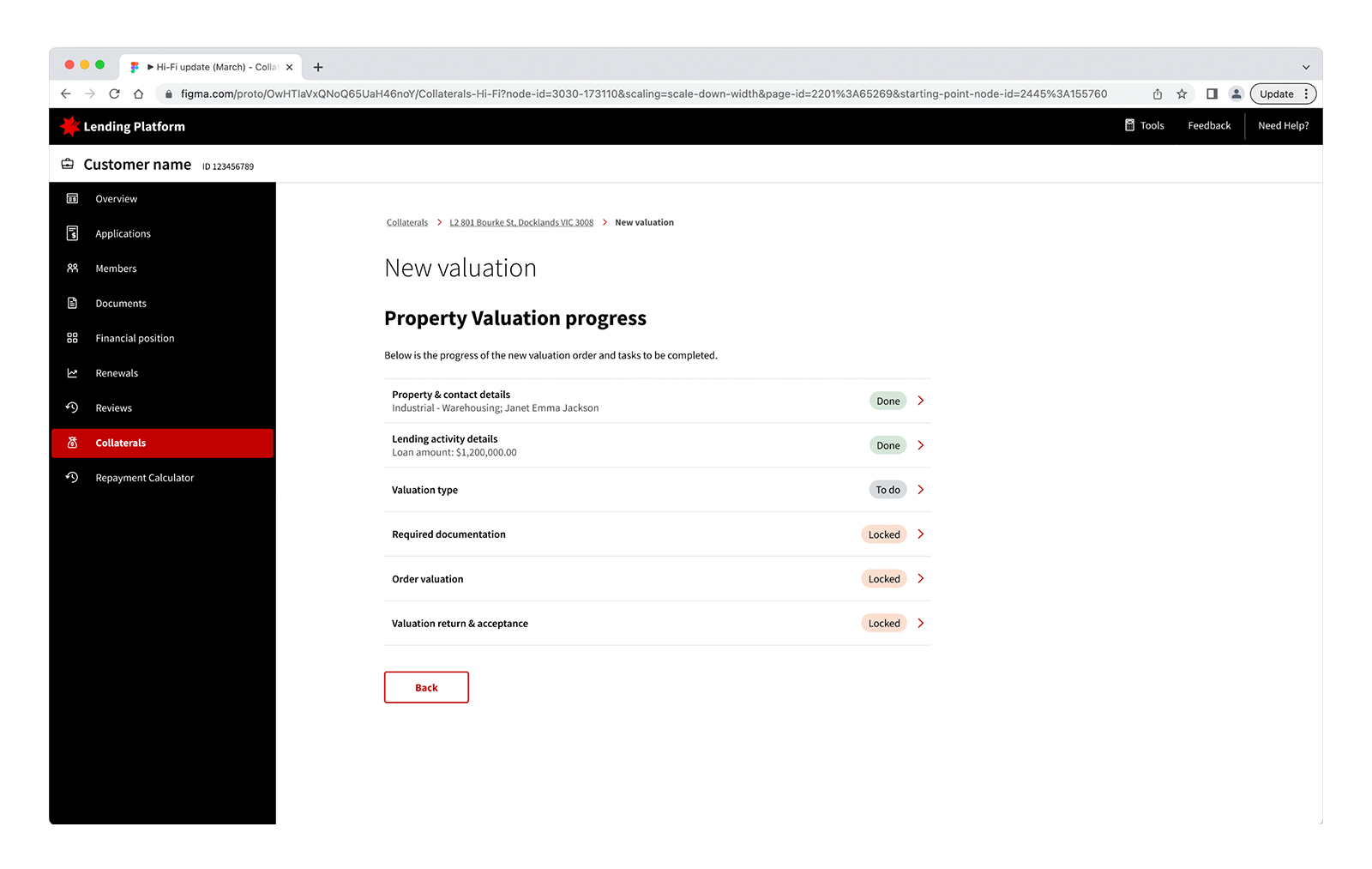

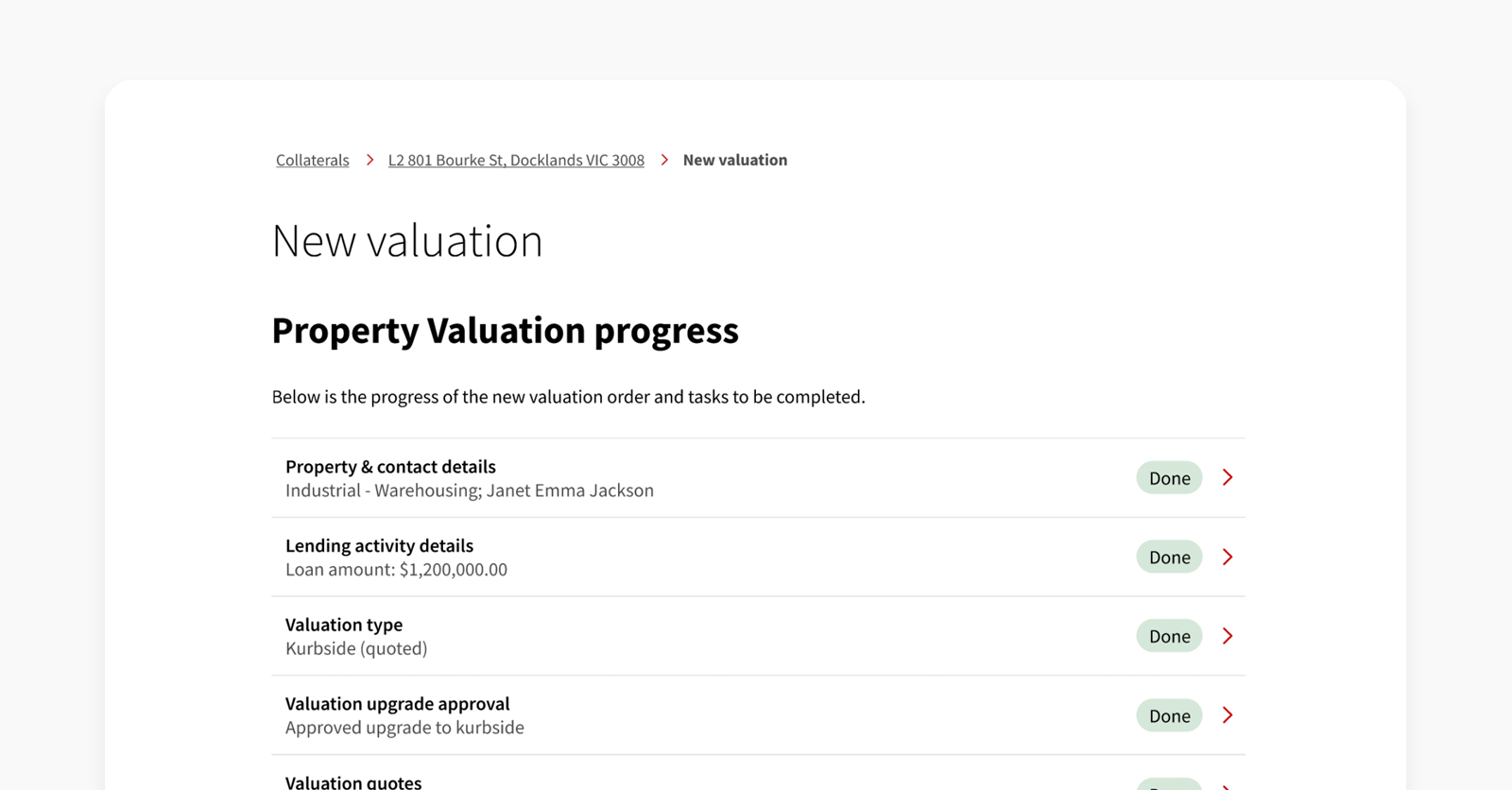

While working through our design processes and reviewing new requirements being put forward by the business it was important to define an MVP which would consider the needs of our bankers against business goals. This meant some capability would be backlogged for future release.

Most of these challenging decisions were based around balancing automation against manual work for bankers.

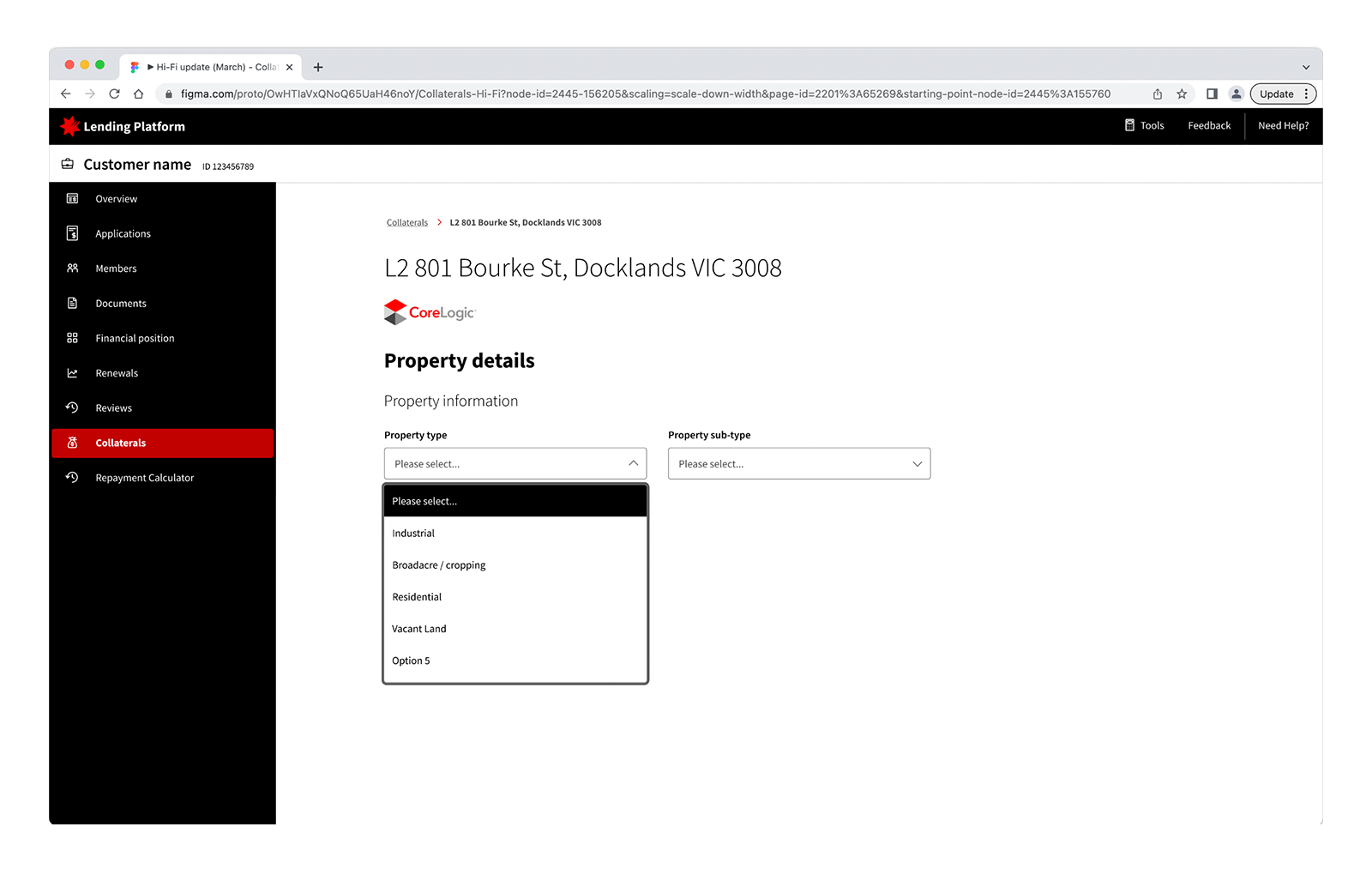

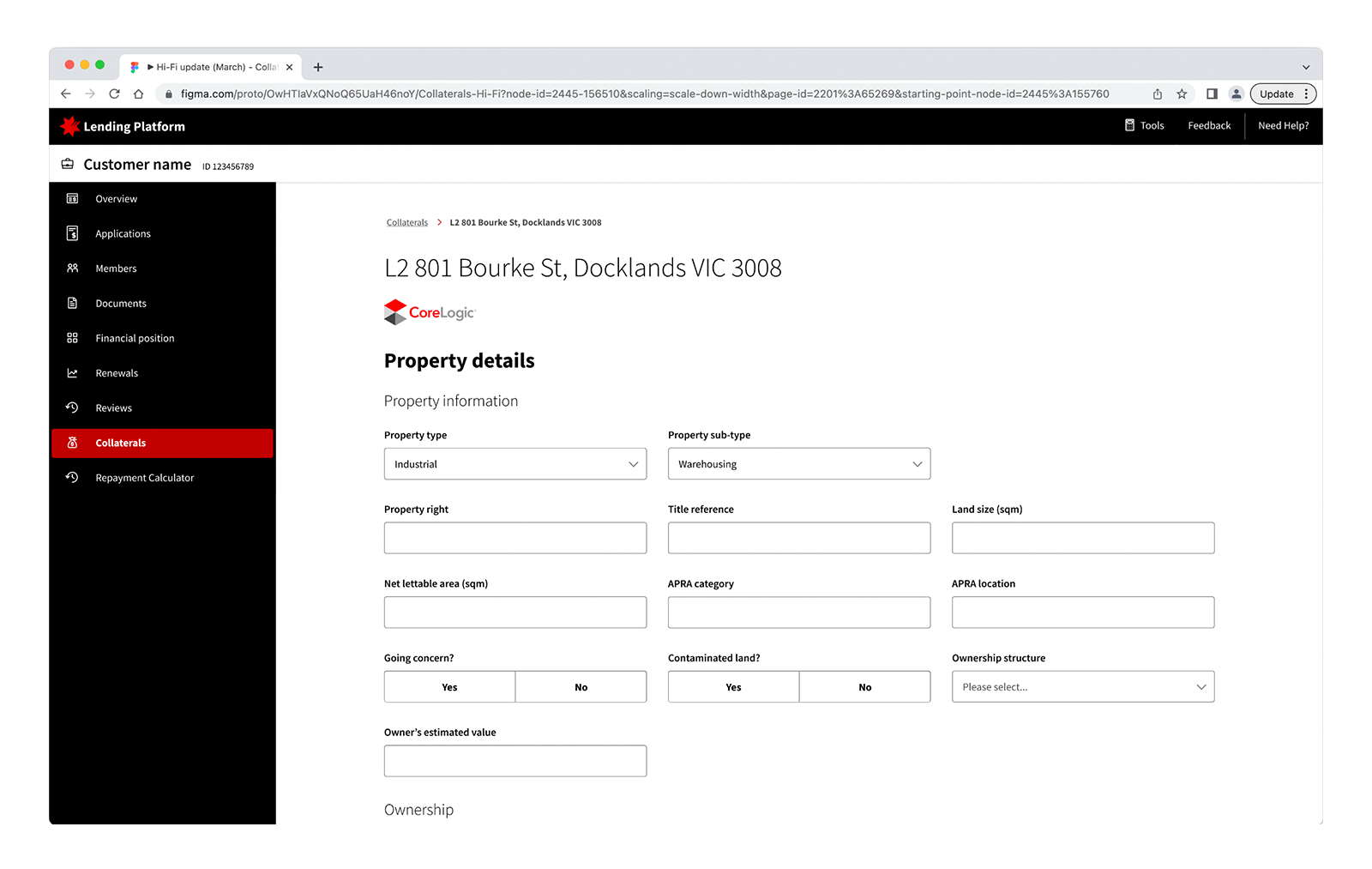

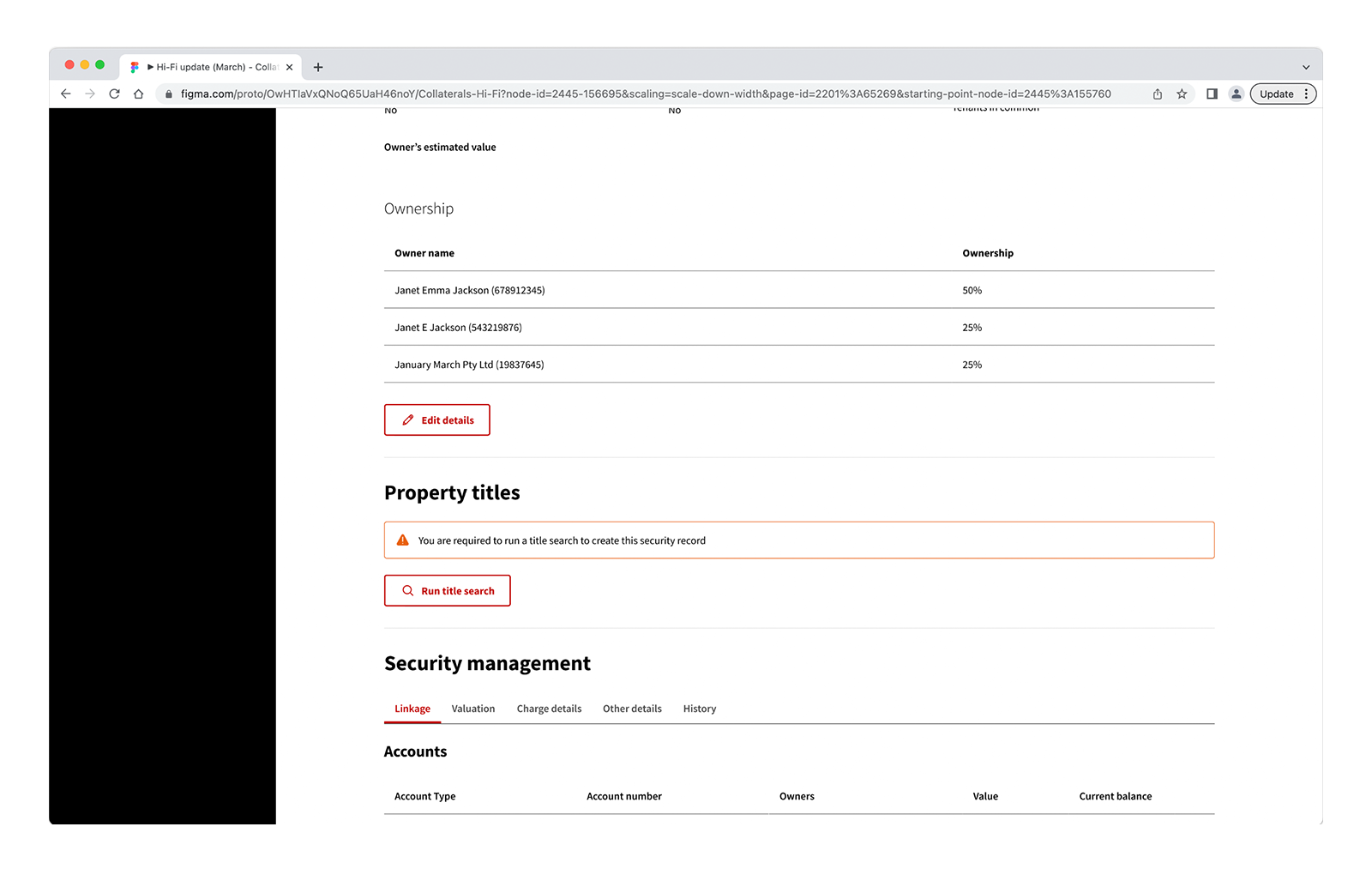

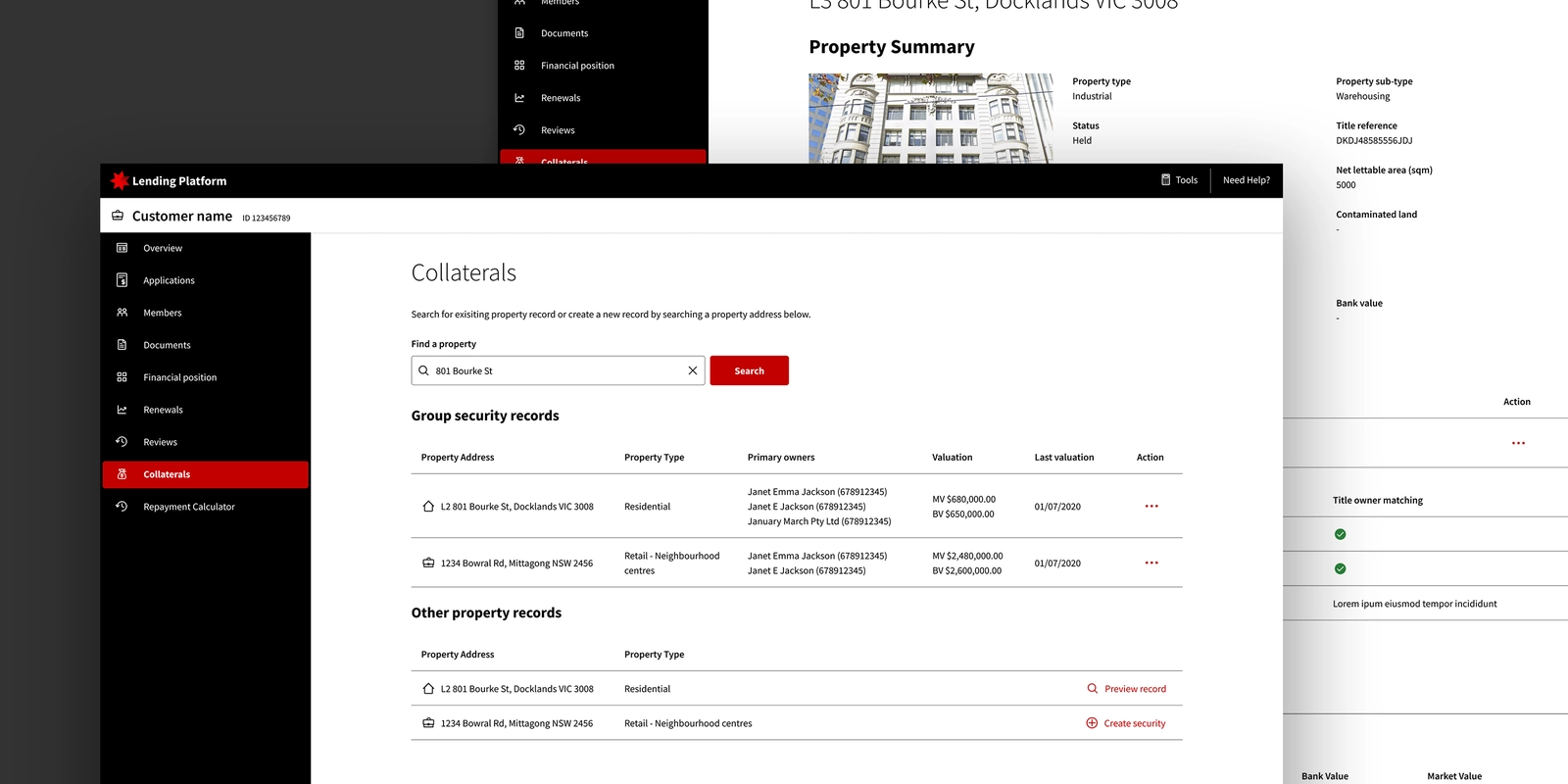

Creating data relationships

Probably the most complex and challenging part of the design was based around how we simplify creating relationships between lending activities, securities and customers. While it sounds like it may be simple, many corporate and commercial scenarios make this very challenging.

Multiple actor interactions

Through out the end-2-end lending journey, multiple different bankers may work on the deal. This is includes frontline bankers, associates who process the submissons, credit decision makers and fulfilment teams. While we would have liked to automate more of the interactions across these actors, limitations meant we needed to prioritise those that were most important.

While work on the platform is ongoing, the initial pilot release was a success. Bankers welcomed the new way of working, especially surfacing of the database inside their existing application workflows, rather than needing to pivot into another system.

Manual input of data between system was limited, while new and inexperienced bankers enjoyed better guidence and support throughout their journey.